Irs underpayment penalty calculator

Calculate Form 2210. If you owe the IRS 1000 and your tax liability is 500 you would calculate the underpayment penalty as follows.

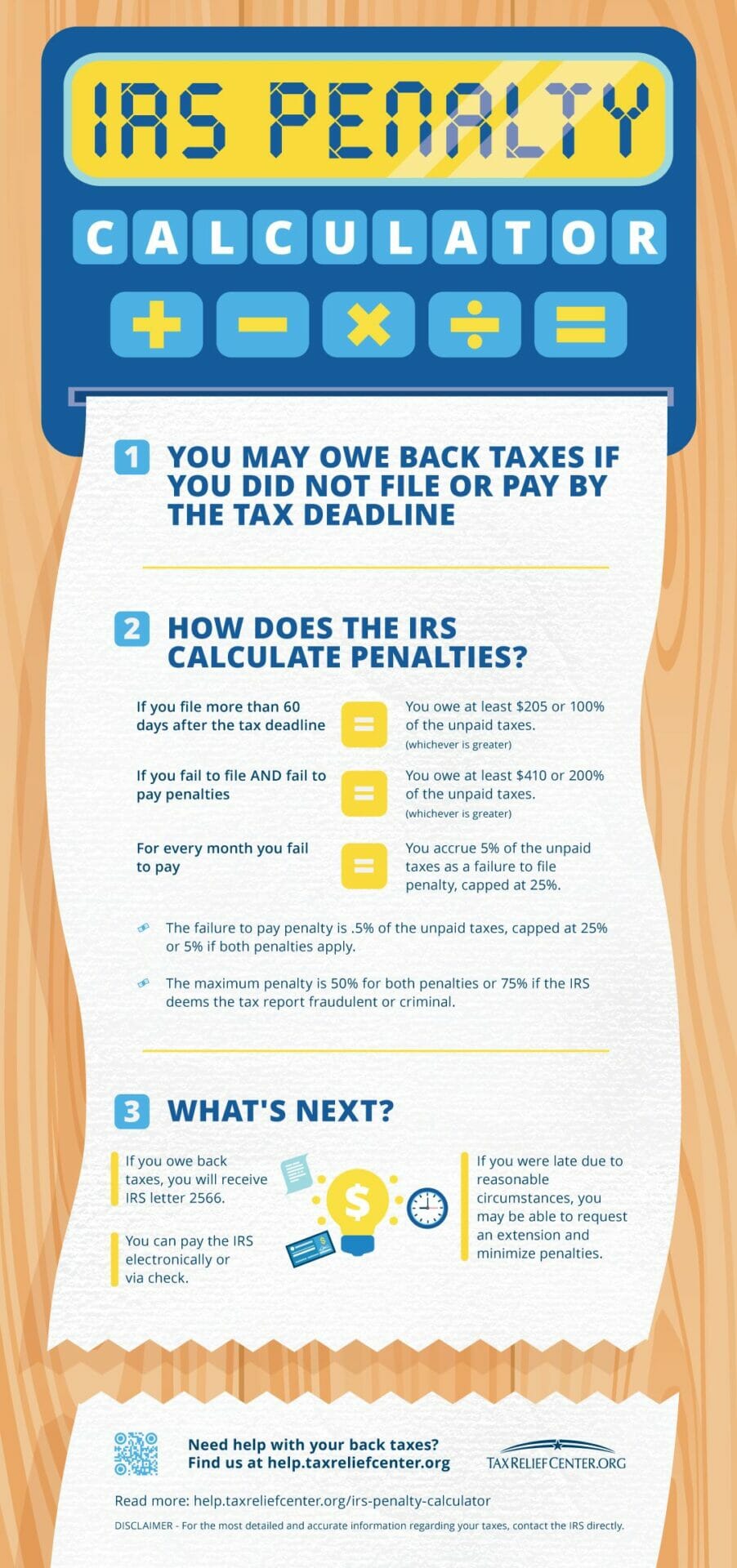

Irs Penalty Calculator Infographic Tax Relief Center

Add the result to the underpayment balance to get the amount you owe for the current day.

. File your tax return on time. Penalty is 5 of the total unpaid tax due for the first two months. Interest is calculated by multiplying the unpaid tax owed by the current interest rate.

After two months 5 of the. 1000 500 500 x 100 100. Instead its based on.

For the 2018 tax year the IRS waived the underpayment penalty for any taxpayer who paid at least 80 rather than the usual 90 of their total 2018 federal tax. Taxpayers who dont meet their tax obligations may owe a penalty. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid.

We calculate the amount of the Underpayment of Estimated Tax by Corporations Penalty based on the tax shown on your original return or on a. Underpayment of Estimated Tax Penalty Calculator. IRS tax penalty calculator is an online tool to compute the amount of penalty that the IRS may impose for your failure to file a tax return by the due date and for failure to pay the.

Underpayment of Estimated Tax. We calculate the Failure to Pay Penalty based on how long your overdue taxes remain unpaid. Calculating the underpayment penalty is complicated because unlike other IRS penalties its not a standard percentage or flat dollar amount.

The IRS charges a penalty for various reasons including if you dont. The underpayment of estimated tax penalty calculator prepares and prints Form 2210. Iowa Fuel Tax Credit from.

Unpaid tax is the total tax required to be shown on your return minus amounts. Click startedit next to Underpayment Penalties. You can also choose to have the IRS figure out your penalty.

Recommends that taxpayers consult with a tax professional. The penalty does not apply for a return with no tax due. As an example if your underpayment is 500 and the interest rate is.

Our IRS Penalty Interest calculator is 100 accurate. Go through the above section for Underpayment Penalty and. Trial calculations for tax after credits under 12000.

Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid. Our sole and only guarantee or warranty is that. Based on the tax brackets for 2022 for a.

This is approximately 31 of your tax obligation 2000 divided by 6500 and it is less than your prior years income tax. How We Calculate the Penalty. Unlike most tax penalties that are assessed based on an annual liability the underpayment of estimated tax penalty is calculated--and assessed.

39 rows In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any. For individuals a substantial understatement of tax applies if you understate your tax liability by 10 of the tax required to be shown on your tax return or 5000 whichever. Underpayment Corporate and Non-Corporate 3 3 5 5 GATT part of a corporate overpayment exceeding 10000 05.

To avoid a late payment penalty you must pay all tax due be-fore the return due date or pay all tax interest and penalties. There is a penalty of 05 per month on the unpaid balance. Underpayment of Estimated Tax Penalty.

You will likely have to pay an underpayment penalty unless you.

Calculate Estimated Tax Penalties Easily

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Debt Categories How Much Taxes Do I Owe The Irs

Irs Penalty Calculator Infographic Tax Relief Center

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

Income Tax Calculator Estimate Your Refund In Seconds For Free

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros